nahabino-kvartira.ru News

News

How To Set Up Automatic Deposit

How do I set up direct deposit? · Select the account you'd like your direct deposit sent to. · Choose Manage at the top of the screen. · Scroll and select Set. Here's what to do: · Sign in to your financial institution's online banking service. · Navigate to the Interac e-Transfer section and look for the “Autodeposit”. Sign in to the National Bank app. · Click Transfers at the bottom of the screen. · Under More options, select Interac e-Transfer® Autodeposit. · Click Add an. Send scheduled automatic deposits from your bank account to your Vanguard account. Set up or change an automatic deposit. Send money through a direct deposit. How to Set up Direct Deposit New customers can select direct deposit as your benefit payment option when you apply for any of our benefit programs. Existing. Send scheduled automatic deposits from your bank account to your Vanguard account. Set up or change an automatic deposit. Send money through a direct deposit. How do I set up Autodeposit for INTERAC e-Transfer? · From the My Accounts landing page, select Interac e-Transfer® from the menu on the left or Interac e-. It normally takes one to three days for a direct deposit to process. Sometimes the payment will show up right away with a “pending” designation until it's. Check with your employer's payroll office, you may be able to set up your direct deposit through an online portal. If not: Complete a direct deposit form. How do I set up direct deposit? · Select the account you'd like your direct deposit sent to. · Choose Manage at the top of the screen. · Scroll and select Set. Here's what to do: · Sign in to your financial institution's online banking service. · Navigate to the Interac e-Transfer section and look for the “Autodeposit”. Sign in to the National Bank app. · Click Transfers at the bottom of the screen. · Under More options, select Interac e-Transfer® Autodeposit. · Click Add an. Send scheduled automatic deposits from your bank account to your Vanguard account. Set up or change an automatic deposit. Send money through a direct deposit. How to Set up Direct Deposit New customers can select direct deposit as your benefit payment option when you apply for any of our benefit programs. Existing. Send scheduled automatic deposits from your bank account to your Vanguard account. Set up or change an automatic deposit. Send money through a direct deposit. How do I set up Autodeposit for INTERAC e-Transfer? · From the My Accounts landing page, select Interac e-Transfer® from the menu on the left or Interac e-. It normally takes one to three days for a direct deposit to process. Sometimes the payment will show up right away with a “pending” designation until it's. Check with your employer's payroll office, you may be able to set up your direct deposit through an online portal. If not: Complete a direct deposit form.

How Can I Set Up Direct Deposit? · Sign in to your online banking account using a web browser. · Select the Checking account you'd like to enroll in direct. Here's what to do: · Sign in to your financial institution's online banking service. · Navigate to the Interac e-Transfer section and look for the “Autodeposit”. Set up recurring deposits · Select Account (person icon) → in the app, Menu (3 bars) · Select Transfers · Select Manage recurring deposits · Choose a recurring. What is Direct Deposit? · Log in to your account. · Sign in and Select the blue Benefits & Payment Details link on the right side of the screen. · Scroll down and. Get started with the Interac† Autodeposit demo. In this demo you'll learn how to set up Interac Autodeposit. Click on the Setup page. · Under the Guest payment options heading, go to Set up automatic deposits. · Choose the Deposit type from the drop-down options: Full. How do I set up direct deposit? · Complete the direct deposit form. · Deliver the form and a voided check to your employer. · If you're eligible, your employer. Direct Deposit: Have a portion of your paycheck automatically deposited into your savings account. Learn more about how to set up Direct Deposit with your. Setting up an automatic savings plan can be done in Online Banking through a process known as reccurring transfers. To set up direct deposit you'll need to provide your bank account information, typically to an employer. Learn more about how to set up direct deposit. Direct deposit is an electronic payment from one bank account to another. The benefits abound with this type of automated transfer, and it's easy to get. Set up payroll direct to an eligible Fidelity accountLog In Required · Send money to or from a bank account with an electronic funds transfer (EFT). · Wire money. Automated investing simply means setting up automatic transfers into your investment accounts to keep you on track to reach your goals. An automatic savings plan generally involves regular deposits of a predetermined amount into a savings account. How do I set up direct deposit? · Ask your employer for a direct deposit form. If they don't have one, you can probably get one from your bank or credit union. Mobile Check Deposit · Send & Receive Money with Zelle® · Transfer Between Set up automatic transfers from checking to savings; Move funds between. To set up a recurring transfer, please log in to your Savings account and click on the "Make a Transfer" tab. Enter the amount you wish to transfer and select. Step 1: Find the Manage Autodeposit option · Step 2: Set up or add Autodeposit · Step 3: Enter deposit information · Step 4: Review and confirm. Automatic savings plans allow you to set up automatic transfers, at a time Certificates of Deposit (CDs). Up to. %. APY*. No minimum balance.

Udacity Rpa

In this course, we will learn what Robotic Process Automation (RPA) is, and the benefits of implementing RPA in your work. The Control Flow in RPA course provides a deep understanding of the automation flow. Control Flow is a concept that refers to the order in which actions are. In this course, we will learn the key concepts of RPA, including the history, business benefits, and application of the technology across different. He is also an instructor at Udacity for the RPA Developer Nanodegree program. In addition, he continues to evangelize RPA by mentoring learners to develop. He is also an instructor at Udacity for the RPA Developer Nanodegree program. In addition, he continues to evangelize RPA by mentoring learners to develop. Udacity, UiPath Launch Robotic Process Automation Developer Nanodegree® Program to Future-Proof Careers. Press Release. September 8, UiPath Announces. After passing this course' assessment, you will get direct access to Udacity classroom. Prerequisites. You should meet the following criteria: More Details. the leading enterprise robotic process automation software company. Taught by industry-leading RPA experts, the Udacity RPA Developer Nanodegree program. Contribute to udacity/ndc1-intro-to-uipath-rpa-project-starter development by creating an account on GitHub. In this course, we will learn what Robotic Process Automation (RPA) is, and the benefits of implementing RPA in your work. The Control Flow in RPA course provides a deep understanding of the automation flow. Control Flow is a concept that refers to the order in which actions are. In this course, we will learn the key concepts of RPA, including the history, business benefits, and application of the technology across different. He is also an instructor at Udacity for the RPA Developer Nanodegree program. In addition, he continues to evangelize RPA by mentoring learners to develop. He is also an instructor at Udacity for the RPA Developer Nanodegree program. In addition, he continues to evangelize RPA by mentoring learners to develop. Udacity, UiPath Launch Robotic Process Automation Developer Nanodegree® Program to Future-Proof Careers. Press Release. September 8, UiPath Announces. After passing this course' assessment, you will get direct access to Udacity classroom. Prerequisites. You should meet the following criteria: More Details. the leading enterprise robotic process automation software company. Taught by industry-leading RPA experts, the Udacity RPA Developer Nanodegree program. Contribute to udacity/ndc1-intro-to-uipath-rpa-project-starter development by creating an account on GitHub.

#RPAInsiders conference! Get a chance to win 1 of 50 free RPA Developer Nanodegree programs. Please note, you must attend the conference in. Learn online and advance your career with courses in programming, data science, artificial intelligence, digital marketing, and more Discovering RPA. 1 day. RPA. RPA Fundamentals · Power Automate · UiPath. Business Communication Udacity's courses focus more on data science related subjects, and often. Udacity Solutions for the Public Sector · Intro to Programming · Java Programming · Android Basics by Google · RPA Developer with UiPath. Take our RPA for Beginners course and learn what Robotic Process Automation (RPA) is and the benefits of implementing RPA in your work. RPA Fluency. at. UDACITY. Udacity and CARLA simulators. 2) Following the need for comparative study, over both simulated datasets, it benchmarks the performance of existing. Udacity Solutions for the Public Sector · Intro to Programming · Java Programming · Android Basics by Google · RPA Developer with UiPath. WARNING, DON´T GET SCAMMED BY UDACITY! (Nanodegrees review). I´d like to offer my experience with Business Analytics, Power BI and Programming. Robotics Specialization– Coursera. Artificial Intelligence for Robotics– Udacity FREE Course. Robotic Process Automation (RPA) Specialization. In place of a Udacity job placement program, Udacity career services are offered to nanodegree graduates. RPA Developer Nanodegree Program, Programming. In this course, we will learn what Robotic Process Automation (RPA) is, and the benefits of implementing RPA in your work. Former Spotify Global Head of Intelligent Automation Sidney Prescott details her background in tech and previews her upcoming keynote presentation on our. Did you know an #RPA developer can make over $ a year? Learn more about RPA salary expectations and how to get started in the field. Discovering RPA. 1 day., Discovery. Discovering Digital Marketing. 1 day., Discovery. Discovering World Models. 1 day., Discovery. Discovering Predictive. Generative AI can create new content and data, while RPA can automate repetitive tasks. Combined, these two technologies can create a powerful force for. Join UiPath and Udacity's RPA Insiders Virtual conference to learn how businesses drive operational efficiencies, cut costs, and drive revenue using RPA. Learn online and advance your career with courses in programming, data science, artificial intelligence, digital marketing, and more Discovering RPA. 1 hour. Udacity has Robotic Process Automation, a course designed to teach you RPA and help you get started with building software bots. 5. Robotics Process Automation. Can #RPA replace jobs? Hear from top execs like Kristina Kaldon @UiPath, Bryan Lamb nahabino-kvartira.ru, @sidneyinthecity @Spotify and. SpringPeople is an Authorized Training Partner of Udacity. Get Udacity Robotics Software Engineer Training & Certification from Experts.

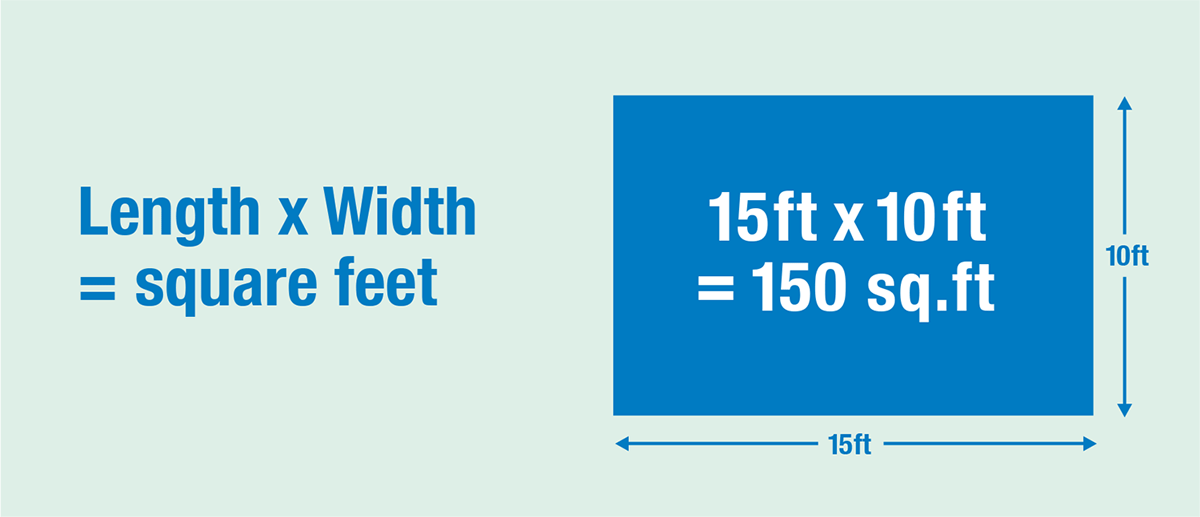

How Determine Square Footage

To calculate the square feet area of a square or rectangular room or area, measure the length and width of the area in feet. Then, multiply the two figures. Calculating square footage is, luckily, pretty simple. You just multiply the length of a room or house in feet by the width in feet. The. This free calculator estimates the square footage of a property and can account for various common lot shapes. To get a rough estimate of the amount of square footage of flooring that you will need for that room, multiply the length of the room by the width of the room. Now measure each door and window for height and width. Multiply height times width to get the square footage of each, and total all the doors and windows. Simply take the length and multiply it by the width. Example: If your length is 3' and your width is 5' 3 X 5 = 15 square feet. Here are five simple steps on how to calculate flooring square footage like a pro and accurately assess your project. Square footage is calculated by multiplying the length and width of a space in feet, which gives you the total square footage for that particular area. For. Here's how to calculate square footage of your glass, when using inches. First, measure the length and width of your glass in inches. Then, multiply these two. To calculate the square feet area of a square or rectangular room or area, measure the length and width of the area in feet. Then, multiply the two figures. Calculating square footage is, luckily, pretty simple. You just multiply the length of a room or house in feet by the width in feet. The. This free calculator estimates the square footage of a property and can account for various common lot shapes. To get a rough estimate of the amount of square footage of flooring that you will need for that room, multiply the length of the room by the width of the room. Now measure each door and window for height and width. Multiply height times width to get the square footage of each, and total all the doors and windows. Simply take the length and multiply it by the width. Example: If your length is 3' and your width is 5' 3 X 5 = 15 square feet. Here are five simple steps on how to calculate flooring square footage like a pro and accurately assess your project. Square footage is calculated by multiplying the length and width of a space in feet, which gives you the total square footage for that particular area. For. Here's how to calculate square footage of your glass, when using inches. First, measure the length and width of your glass in inches. Then, multiply these two.

Multiply the length of the first space by the width of the first space. To find the square footage -- or the area -- of the space, just multiply the length. Square Footage Calculator · Length (ft) x Width (ft) = Total Square Feet · x (Diameter (ft)/2)^2 = Total Square Feet · 1/2 x Length of Side 1 (ft) * Length. Every property is different. Knowing the square footage of your yard tells you how much water, fertilizer, or grass seed you will need to maintain it. We simply multiply the width of the floor by the length of the floor, 20 feet times 20 feet equals square feet. Therefore, the total area of the dance floor. If your lot is feet deep and feet wide*, simply multiply X = a total of 13, square feet. Then subtract from this total the square footage. To guide your search and ensure proper measurements, what follows is an easy-to-understand breakdown of how to estimate the square feet in a home. Measure length of each wall including doors and windows. Find the total square feet of the wall(s) by multiplying ceiling height by total wall length. Subtract. To calculate the area of a wall, use the standard formula of Length x Width = Area. Next, use the same formula to record the individual area of windows and. Square footage is the total space in a building. It's calculated by multiplying the length of a structure by its width. How do you calculate square feet from inches? To calculate the square footage of a space based on square inches, divide the square inches value by Square. One can measure the exterior width x length if a one store square house, that is one way. One can use a tape measure and measure the interior. The square footage calculation is simple. All you do is measure the length and width of a room. Then, multiply the two numbers. Here's the full equation. BYJU'S online square footage calculator tool makes the calculation faster, and it displays the square footage in a fraction of seconds. Steps to Calculate Square Feet · Measure the length and width of the area. · Convert these measurements to feet if they aren't already. · Multiply the length in. Use our handy Square Footage Calculator to determine the measurements of your rooms and plan out how much flooring you'll need to get the job done! To measure a home's square footage, sketch a floor plan of the interior. Break down the sketch into measurable rectangles. Go through the house measure the. Square footage also known as square feet is a unit generally used to express the area of a surface. To find square feet, the length measurement in feet is. All you need to do is multiply the length of the room by the width of the room. From example, if a room is 10 feet wide and 15 feet long, you would multiply To measure square feet of a house in India, you will need a measuring tape and a calculator. Step 1: Measure the length and width of each room.

What Does Ria

A Registered Investment Advisor ("RIA") and an Investment Advisor Representative ("IAR") are distinctly different. A RIA is the legal entity that is formed. They are giant Registered Investment Advisors (RIA) that happen to also have a broker/dealer alongside. It is the RIA component of the large broker/dealer. Registered Investment Advisors (RIAs) are financial services firms registered with the SEC or state securities regulators. They have a fiduciary responsibility. What does RIA stand for? ; RIA, Rights in Action (various organizations) ; RIA, Research in Action ; RIA · Registered Investment Advisor ; RIA · Rich Internet. Explore the benefits of the RIA model, key differences between hybrid and fee-only RIAs, and what to consider before starting or joining an RIA. Learn More. Registered Investment Advisors (RIAs). Streamline and automate the wealth management process so you can focus on enhancing your clients' total financial. Frequently Asked Questions. A Registered Investment Advisor (RIA) is an Investment Advisor registered with the Securities and Exchange Commission or a state's. Ria definition: a long, narrow inlet of a river that gradually decreases in depth from mouth to head.. See examples of RIA used in a sentence. RIA. An RIA (Registered Investment Advisor) is a financial professional or firm that provides personalized investment advice and financial planning services to. A Registered Investment Advisor ("RIA") and an Investment Advisor Representative ("IAR") are distinctly different. A RIA is the legal entity that is formed. They are giant Registered Investment Advisors (RIA) that happen to also have a broker/dealer alongside. It is the RIA component of the large broker/dealer. Registered Investment Advisors (RIAs) are financial services firms registered with the SEC or state securities regulators. They have a fiduciary responsibility. What does RIA stand for? ; RIA, Rights in Action (various organizations) ; RIA, Research in Action ; RIA · Registered Investment Advisor ; RIA · Rich Internet. Explore the benefits of the RIA model, key differences between hybrid and fee-only RIAs, and what to consider before starting or joining an RIA. Learn More. Registered Investment Advisors (RIAs). Streamline and automate the wealth management process so you can focus on enhancing your clients' total financial. Frequently Asked Questions. A Registered Investment Advisor (RIA) is an Investment Advisor registered with the Securities and Exchange Commission or a state's. Ria definition: a long, narrow inlet of a river that gradually decreases in depth from mouth to head.. See examples of RIA used in a sentence. RIA. An RIA (Registered Investment Advisor) is a financial professional or firm that provides personalized investment advice and financial planning services to.

An RIA manages the assets of affluent, often high-net-worth individuals and institutional investors.

What Does An RIA Do? An RIA manages the investment portfolios of high-net-worth individuals. RIAs are fundamentally obliged to advise their clients in a way. Registered Investment Advisor (RIA) is an individual or a firm that advises high net worth individuals on investments and manages their portfolios. RIAs will. Whether you are currently with a wirehouse, a broker-dealer or already with a registered investment adviser (RIA), there are many things that you may want to. A common reason advisors don't go independent and launch their own RIA firms is their fear that clients won't follow them when they do. Take the time to. Ria Financial, founded in , is one of the largest money transfer companies in the world, with a global network that's constantly growing. Additionally, the definition of investment adviser under the Investment Advisers Act of does not include lawyers, accountants, engineers, and teachers if. With Ria, you can send money online and in person, use digital tools to find a location or track your transfer, or have a working relationship with us. Rise to (r)evolution. Being an RIA is about being independent. About growing a business. About putting your clients at the center of everything you do. We. As a Firm we fundamentally believe in the Registered Investment Advisor (RIA) model as it aligns the interest of advisors with that of our clients. We do not. A Registered Investment Advisor ("RIA") and an Investment Advisor Representative ("IAR") are distinctly different. A RIA is the legal entity that is formed. A registered investment adviser (RIA) is a firm that is an investment adviser in the United States, registered as such with the Securities and Exchange. Having served as a Chief Compliance Officer for multiple SEC-registered investment advisers, take it from me: Keep the SEC happy. And the only way to do it is. Ria Money Transfer is one of the largest international money transfer service providers in the world. Send money from the US using your bank. Ria Money Transfer is a subsidiary of Euronet Worldwide, Inc., which specializes in money remittances. If firms want to give advice as fiduciaries for a fee, they must register as RIAs to do so. The following chart aggregates total assets for all registered firms. The Institutional Investor RIA Institute is a private membership organization for the nation's largest and fastest-growing independent registered investment. A Registered Investment Adviser (RIA) refers to a licensed individual financial adviser or a firm that offers financial guidance to clients. RIAs offer financial advice to clients, including advice related to investment management. A registered investment advisor may execute trades on your behalf or. Do you have an entrepreneurial spirit? Forming your own registered investment advisor (RIA) firm can allow you to take control of your future, keep more of what.

Debt Consolidation Loan For High Credit Utilization

The best debt consolidation loans are from LightStream, SoFi and PenFed Credit Union. These lenders offer interest rates lower than average credit card rates. By taking out a debt consolidation loan and paying off the charges, you'll lower your utilization rate, which can improve your credit score. Just be sure to. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Upstart: Best for borrowers with bad credit · Discover. Debt consolidation is when someone takes out a loan and uses it to pay off other loans—often high-interest debt like credit cards and car loans. You try to. When you pay off a credit card with a debt consolidation loan, it drops your credit utilization for that card to 0%, which can help your credit scores. Keep in. But because of my high utilization (64%) I get denied. I suppose a debt consolidation loan could help but I want to get a house within the. Debt consolidation is a debt management strategy that combines your outstanding debt into a new loan with just one monthly payment. Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. Debt consolidation is combining multiple bills into one large debt that is paid off with a loan or debt-relief program that has more favorable interest rates. The best debt consolidation loans are from LightStream, SoFi and PenFed Credit Union. These lenders offer interest rates lower than average credit card rates. By taking out a debt consolidation loan and paying off the charges, you'll lower your utilization rate, which can improve your credit score. Just be sure to. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Upstart: Best for borrowers with bad credit · Discover. Debt consolidation is when someone takes out a loan and uses it to pay off other loans—often high-interest debt like credit cards and car loans. You try to. When you pay off a credit card with a debt consolidation loan, it drops your credit utilization for that card to 0%, which can help your credit scores. Keep in. But because of my high utilization (64%) I get denied. I suppose a debt consolidation loan could help but I want to get a house within the. Debt consolidation is a debt management strategy that combines your outstanding debt into a new loan with just one monthly payment. Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. Debt consolidation is combining multiple bills into one large debt that is paid off with a loan or debt-relief program that has more favorable interest rates.

Why choose Upstart for a debt consolidation loan? We think you're more than your credit score. Our model looks at other factors, like education³ and. “Consolidating credit card debt into an unsecured personal loan can be a good option to pay your debt off while freeing up funds in your monthly budget. Debt consolidation loans will typically allow higher levels of borrowing than credit card balance transfer options and lower interest rates than most credit. LightStream: Best for high-dollar loans and longer repayment terms. LightStream · · yrs* · $5k- $K ; Upstart: Best for little credit history. This process involves using a lump-sum personal loan to roll your high-interest debts into a single monthly payment. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Upstart: Best for borrowers with bad credit · Discover. Look into combining high-interest balances into a single loan with better terms. Personal loan interest rates tend to run significantly lower than comparable. Debt consolidation loans reduce the number of debt payments you make each month and could even shorten the amount of time you're repaying debt. A debt consolidation loan is a form of debt refinancing that combines multiple balances from credit cards and other high-interest loans into a single loan. Higher credit utilization, in some cases: If you use a balance transfer credit card to pay off an installment loan, like an auto loan, you could decrease. Simplify your finances by consolidating higher-interest debt with Personal Loan rates as low as % APR. If you're overwhelmed by multiple high-interest debts, consolidating could save you money on interest and help you get out of debt faster. We found the best. Wells Fargo offers the best large debt consolidation loans, giving borrowers up to $,, to be repaid within 12 - 84 months. Wells Fargo has a competitive. The best debt consolidation loans if you have bad credit ; Best for people without a credit history. Upstart Personal Loans · % - % ; Best for flexible. A debt consolidation loan is an unsecured personal loan that you take out to consolidate multiple lines of credit card debt and/or other debts with high. With a debt consolidation loan, you apply for a specific amount of money to cover your total debt. If the lender approves you, it will usually pay your. Raise your credit score by lowering your credit utilization. Streamline your monthly payment. See How Much You Can Save. By extending the loan term, you may pay more in interest over the life of the loan. By understanding how consolidating your debt benefits you, you will be in a. Say goodbye to high-interest credit card debt with a debt consolidation loan from SoFi Lower your credit utilization. A personal loan for debt. Higher credit utilization, in some cases: If you use a balance transfer credit card to pay off an installment loan, like an auto loan, you could decrease.

Chime Joint Savings Account

SoFi joint bank accounts have no account fees, unlimited transfers, and up to % APY. See why SoFi was voted the Best Joint Checking Account of You are unable to find your bank listed by Plaid. Please Note: River does not support Chime Bank, Green Dot Bank, or Walmart Money Card at this time. Get. no chime does not offer joint banking. it is used for individual and personal use only. what i did in the past was gave my significant other. Bank to Bank Transfers, available through Online Banking, provides the convenience to schedule money transfers between your M&T personal deposit account. Chime savings account offers an APY of % (APY stands for annual percentage yield, rates may change). This is much higher than the average savings account. The bank pays % APY on your annual deposits, helping you grow your savings. Parents also love Capital One Money, as they encourage joint accounts where. Open your Chime checking account online for free and easily manage your money 24/7. No monthly service fees, access fee-free ATMs. For users on iOS running app version or later, any external bank accounts that have been linked to your Chime Checking Account now appear in a widget on. A joint bank account can be handy when combining or sharing your finances. Whether you're saving for a mutual goal with your significant other. SoFi joint bank accounts have no account fees, unlimited transfers, and up to % APY. See why SoFi was voted the Best Joint Checking Account of You are unable to find your bank listed by Plaid. Please Note: River does not support Chime Bank, Green Dot Bank, or Walmart Money Card at this time. Get. no chime does not offer joint banking. it is used for individual and personal use only. what i did in the past was gave my significant other. Bank to Bank Transfers, available through Online Banking, provides the convenience to schedule money transfers between your M&T personal deposit account. Chime savings account offers an APY of % (APY stands for annual percentage yield, rates may change). This is much higher than the average savings account. The bank pays % APY on your annual deposits, helping you grow your savings. Parents also love Capital One Money, as they encourage joint accounts where. Open your Chime checking account online for free and easily manage your money 24/7. No monthly service fees, access fee-free ATMs. For users on iOS running app version or later, any external bank accounts that have been linked to your Chime Checking Account now appear in a widget on. A joint bank account can be handy when combining or sharing your finances. Whether you're saving for a mutual goal with your significant other.

Existing customers can earn a bonus by referring a friend. Still, a promotion shouldn't be the only reason you open a bank account, so make sure the account. bank accounts in the US: a checking account and a savings account. banks that offer great student bank accounts such as Ally, Simple and Chime. Need to make a transfer between your Ally Bank account and an account you own at another financial institution? No problem. External transfers are secure. Chime: $ for a referral and $ to the referred customer; M&T Bank: $50 New SoFi Bank customers can earn up to $ by opening a Checking and Savings. We reviewed and compared monthly fees and minimum balances from the best joint checking accounts. This list will help you find an account that fits your. When you link an external account, you'll have read-only access to it on your dashboard. There's no limit to how many will display, and most types of accounts. Just like applying for a new credit card, you have to be approved to open a bank account. Though it may be easier to qualify, here's what to do if you're. Open an exempt account, such as a joint marital account as tenants by entireties. Tenants by entireties assets are exempt under Florida common law if the debt. If you're opening a bank account for kids at another bank, typically the adult must sign up and then add the child on as the joint account holder. You'll need. Send money to another bank account from the United States 24/7 using Western Union. Learn how to send money online, in person or through our international. Chime is not a bank but a financial technology company. It partners with The Bancorp Bank, N.A. or Stride Bank, N.A., to provide banking solutions designed to. Need to open a bank account and have a bad credit score? Open a second chance banking account through Chime with no credit check or minimum deposit. Chime offers a free checking account, a savings account with up to 2% APY and a credit-building card with no annual fee or interest charges. The bank pays % APY on your annual deposits, helping you grow your savings. Parents also love Capital One Money, as they encourage joint accounts where. What is a checking account and how do you open one? Find answers to this and other frequently asked questions about checking accounts at Citizens. Chime Banking. Remove Bank. Capital One. Checking. Remove Bank. Fifth 4 ways to add funds to your new bank account. Learn how several free and easy. We want to make it easier for you to share your financial data with the apps you want to use. Whether you have an account at a national bank, a local bank, a. Linking a bank account will allow you to move funds into your HSA Account to cover out-of- pocket medical expenses. Linking a bank account. accounts. Remember: You can ask IRS to direct deposit your refund into your U.S. bank or U.S. bank affiliated account, your spouse's account or a joint account. Chime is a full-featured deposit account. Your account can receive direct deposits and it supports pre-authorized withdrawals and interbank transfers.

Completion Bond Vs Performance Bond

A performance bond ensures project completion as per contract terms, and a payment bond guarantees contractor payments to subcontractors and suppliers. A performance bond is a type of contract construction bond that guarantees a contractor will complete a project according to the terms outlined in a contract. Performance bonds ensure contractors fulfill their individual contracts, while completion bonds ensure contractors finish projects even if they aren't paying. A performance bond is a surety bond that is issued by a bonding company or bank to guarantee satisfactory completion of a project by a contractor. It protects. Film Production Completion Bond is a written contract that guarantees a motion picture will be finished and delivered on schedule and within budget. In filmmaking, a completion guarantee (sometimes referred to as a completion bond) payment of minimum distribution guarantees to the producer (but received by. It provides more coverage than a simple Performance Bond, which ensures that one party will perform if the other will perform, usually by payment. The. A completion bond provides more coverage than a performance bond, which guarantees satisfactory completion of the job. Completion bonds create a guarantee. Unlike the Performance Bond, the Completion Bond is taken out by the project developer and the recipient of the funds, not the construction contractor. A performance bond ensures project completion as per contract terms, and a payment bond guarantees contractor payments to subcontractors and suppliers. A performance bond is a type of contract construction bond that guarantees a contractor will complete a project according to the terms outlined in a contract. Performance bonds ensure contractors fulfill their individual contracts, while completion bonds ensure contractors finish projects even if they aren't paying. A performance bond is a surety bond that is issued by a bonding company or bank to guarantee satisfactory completion of a project by a contractor. It protects. Film Production Completion Bond is a written contract that guarantees a motion picture will be finished and delivered on schedule and within budget. In filmmaking, a completion guarantee (sometimes referred to as a completion bond) payment of minimum distribution guarantees to the producer (but received by. It provides more coverage than a simple Performance Bond, which ensures that one party will perform if the other will perform, usually by payment. The. A completion bond provides more coverage than a performance bond, which guarantees satisfactory completion of the job. Completion bonds create a guarantee. Unlike the Performance Bond, the Completion Bond is taken out by the project developer and the recipient of the funds, not the construction contractor.

Site or completion bond—guarantees of completion involving contractor financing Related: "The ABCs of Surety Bonds: What's the difference between surety bonds. Payment bonds guarantee payment for services throughout a construction project while performance bonds guarantee project completion. Performance Bonds vs. Bonds vs. Insurance. They are both risk transfer mechanisms. Insurance is completion. The performance bond typically includes a one year maintenance. Completion Assurance: Performance bonds assure property owners that the project will be completed according to the terms of the construction agreement. In the. A performance bond is issued by one party to contract to the other party as a guarantee against the issuing party's failure to meet their obligations. To provide a guarantee that the project will be completed, owners can require a performance and payment bond. Performance Bonds provide assurance to the. An MCS provider shall furnish to the Mayor, a completion bond prior to the time it commences a construction, upgrade, rebuild, or repair/maintenance project. A subdivision bond, also referred to as a site improvement bond, completion bond or plat bond, is essentially a performance bond. The National Association of Surety Bond Producers (NASBP) is a national trade association of agencies employing surety bond producers, including producers. A performance bond is a financial guarantee that ensures a contractor completes the project as per the contract terms; it is typically required in. These bonds are a type of contract surety that you post in order to obtain building permits and begin construction of a new building or development. A completion bond ensures the successful completion of an entire project, not just the fulfillment of one specific contract. This means that it may be used to. A performance bond is a financial guarantee to one party in a contract against the failure of the other party to meet its obligations. A performance bond is a type of surety bond that guarantees the completion of a contracted project. A performance bond is a type of surety bond given by an insurance company to ensure proper completion of (or the performance on) a project by a contractor. Bid bonds are different from performance and payment bonds because they insure the project owner in the pre-project bidding process alone. A Maintenance Surety Bond provides protection against defects on construction improvements already put in place. Film Production Completion Bond is a written contract that guarantees a motion picture will be finished and delivered on schedule and within budget. A performance bond is a specific type of surety bond that guarantees to the project owner, or obligee, that the contractor's work will meet their contractual. A surety bond can be used to describe all types of instruments, but in general "surety" means that it shows an agreement or contract. Performance bonds are.

How To Advertise Our Website

Search engine optimization (SEO) is the key strategy that will get your website ranked well in search results. However, there are other things you can do as. Use the web to avoid fees. Learn More · Log in Advertise your business and reach your next customers with precise targeting and actionable insights. How to Promote Your Website for Free · 1. SEO · 2. Organic Social · 3. Branding · 4. Original, Compelling Content · 5. Business Profile on Google · 6. Co-. Maximise leads and conversions · Increase online sales · Drive in-store foot traffic · Capture the full potential of international expansion · Market your app to. Step one for how to promote your business is always to create an online presence with a website. Make sure it includes contact information, details about your. Create a website visitors ad · Go to your Facebook Page. · Click Promote. You can find it at the top of your page. · Select Create new ad. · Select Get more website. Grow your website audience and your small business. Here are low-cost, effective strategies to advertise your small business website. Advertise Your Website for Free: Kick-Start Your Business With Virtually No Expenses · Don't underrate the power of review sites for promoting an online. Here, I'll share some proven, cost-free methods to boost your website's Google ranking and attract more visitors. Search engine optimization (SEO) is the key strategy that will get your website ranked well in search results. However, there are other things you can do as. Use the web to avoid fees. Learn More · Log in Advertise your business and reach your next customers with precise targeting and actionable insights. How to Promote Your Website for Free · 1. SEO · 2. Organic Social · 3. Branding · 4. Original, Compelling Content · 5. Business Profile on Google · 6. Co-. Maximise leads and conversions · Increase online sales · Drive in-store foot traffic · Capture the full potential of international expansion · Market your app to. Step one for how to promote your business is always to create an online presence with a website. Make sure it includes contact information, details about your. Create a website visitors ad · Go to your Facebook Page. · Click Promote. You can find it at the top of your page. · Select Create new ad. · Select Get more website. Grow your website audience and your small business. Here are low-cost, effective strategies to advertise your small business website. Advertise Your Website for Free: Kick-Start Your Business With Virtually No Expenses · Don't underrate the power of review sites for promoting an online. Here, I'll share some proven, cost-free methods to boost your website's Google ranking and attract more visitors.

Read this guide on how to promote your e-commerce store, from SEO to influencer marketing and more. How To Advertise Your Website Online Effectively in 5 Steps · 1. Understand Internet Advertising Jargon · 2. Know Your Advertising Options · 3. Track Everything. YES: Nine reasons to put your fees and prices on your website · Trust. Many potential customers will not do business with a company that is not forthcoming about. 1. Organic social media. This can be a highly effective way to build your audience and drive traffic. The key is to do your research and find the social media. In this article, I'll discuss 12 ways to promote your website for free. So read on and start promoting your website today! There are specific requirements to meet to find advertisers for your website. You need good traffic because brands want to showcase themselves to an engaged. Businesses like yours use Meta ads to increase online sales, drive in-store traffic and find new customers. Whether you're new to online advertising or are. If you want to create backlinks, you can start by reaching out to other websites in your industry for links. You can do this through guest posts or by simply. How to get more people to visit your website, without spending money on advertising. · Tip 1 — SEO or 'Search Engine Optimisation'. Even as an. 1. Organic social media. This can be a highly effective way to build your audience and drive traffic. The key is to do your research and find the social media. 1. Build a social media presence · 2. Join groups on LinkedIn · 3. Create video content · 4. Promote your website with ad spend. From marketing to existing customers to acquiring new ones, let's look at eight tactics you can use to drive traffic to your new online store. 55 Best Ways to Advertise Your Website · 1. Start an Affiliate Program · 2. Publish An Article · 3. Make a Sig Link · 4. Post in Newsgroups · 5. Go Web with. Whether you want to use video, images, or words – or some combination of the three – there's an X ad format that fits your business goals. Website Ads. App. Search engine optimization (SEO) helps your website show up higher in Google search rankings. Using relevant keywords throughout your business's web pages and. Create a website visitors ad · Go to your Facebook Page. · Click Promote. You can find it at the top of your page. · Select Create new ad. · Select Get more website. In this article, you will learn how to create a website that compels online visitors to spend long time browsing the website. 1. Write Useful, High-quality Content · 2. Include Keywords on Your Pages · 3. Earn Backlinks · 4. Use Google Business Profile (GBP) · 5. List Your Business in. If you've wondered about how to promote your business on Facebook, you're not alone. Hubspot reports that 93% of businesses are active on the social media. 55 Best Ways to Advertise Your Website · 1. Start an Affiliate Program · 2. Publish An Article · 3. Make a Sig Link · 4. Post in Newsgroups · 5. Go Web with.

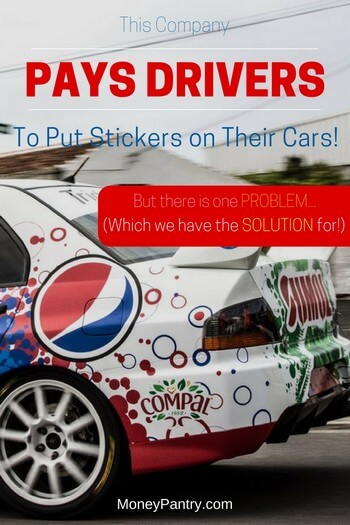

Companies That Pay For You To Advertise On Your Car

Car owners can indeed get paid to put ads on their cars—a procedure known as “wrapping”—but some solicitations to join such advertising companies are scams. Another fun side hustle: Turn your car into a moving billboard. According to FinanceBuzz, companies like Wrapify, Carvertise, and Nickelytics will pay you. Learn how to become a Carvertise driver. Earn up to $/month for something you already do—drive! Join America's largest car advertising co. Car Wrap Advertising Makes Your Companies Message Memorable Remember, even as you run errands, the car is exposing information about your company to others. Take the next step to get an exact, no obligation cash offer on your car from a local dealer right now, and then get paid after a quick inspection of your. Modern Outdoor Advertising. The meteoric rise of Uber, Lyft, and DoorDash has created a new class of vehicles that garner high exposure in front of your. We saw people getting scammed with fake checks that were supposed to be payment for car wrapping all the time. It's like the most common scam, next to romance. The best websites to sell your car online for the most money include nahabino-kvartira.ru, Carvana, CarBrain, Peddle, TrueCar, Copart, CarMax and CarGurus. Earn extra money each month with Wrapify! You can get paid to advertise on your car while you drive for Uber, Lyft, Doordash, Grubhub and more. Car owners can indeed get paid to put ads on their cars—a procedure known as “wrapping”—but some solicitations to join such advertising companies are scams. Another fun side hustle: Turn your car into a moving billboard. According to FinanceBuzz, companies like Wrapify, Carvertise, and Nickelytics will pay you. Learn how to become a Carvertise driver. Earn up to $/month for something you already do—drive! Join America's largest car advertising co. Car Wrap Advertising Makes Your Companies Message Memorable Remember, even as you run errands, the car is exposing information about your company to others. Take the next step to get an exact, no obligation cash offer on your car from a local dealer right now, and then get paid after a quick inspection of your. Modern Outdoor Advertising. The meteoric rise of Uber, Lyft, and DoorDash has created a new class of vehicles that garner high exposure in front of your. We saw people getting scammed with fake checks that were supposed to be payment for car wrapping all the time. It's like the most common scam, next to romance. The best websites to sell your car online for the most money include nahabino-kvartira.ru, Carvana, CarBrain, Peddle, TrueCar, Copart, CarMax and CarGurus. Earn extra money each month with Wrapify! You can get paid to advertise on your car while you drive for Uber, Lyft, Doordash, Grubhub and more.

companies, and auto brokers, but excluding state or local governmental entities. By using this website, you consent to our use of cookies. You can learn more. Got a delivery truck? You could be earning extra income by turning it into a moving billboard. You don't have to do anything differently, your route stays. Have you received a message promising easy money if you wrap your car in an ad pay the “installer” who'll wrap your car with the ad. The scammer will also. If your job requires you to use a vehicle to carry out responsibilities, then it is right for the company to offset expenses. Some state laws even require it. 5 Car Companies That Pay You Advertise on Your Car · Carvertise · Wrapify · StickerRide · ReferralCars · Nickelytics. Keep reading to discover the pros and cons. Wrap2earn allows you to mobilise your Ads to capture the audience of an entire city. Your brand is exposed to a varied audience across demographics. SpeedPro specializes in creating bold graphics that get your message in front of consumers. We do that through custom vehicle wraps. Drive with Drovo to increase your monthly income · Earn substantial monthly passive income for driving as usual · Access additional benefits from Drovo's partners. vehicle sale" Some auto dealers advertise special promotions that say that all you have to pay to buy a car is "$49 down," or other low amount. These ads. The best websites to sell your car online for the most money include nahabino-kvartira.ru, Carvana, CarBrain, Peddle, TrueCar, Copart, CarMax and CarGurus. I just finished a campaign with Carvertise. They pay for the wrap/removal etc. My commitment was 6 months. Made about $ for 6 months. Grow your audience with OOH car advertising! With Wrapify, you can advertise on cars driving for Uber, Lyft, Doordash, Grubhub, Postmates and more. Other dealers promise high trade-in allowances, attractive discounts and rebates, or free or low-cost add-ons, like service contracts. Or if you're looking to. FreeCarMedia. FreeCarMedia is another great company that pays you to wrap your car and drive. According to their website, “A rear window advertisement typically. Take the next step to get an exact, no obligation cash offer on your car from a local dealer right now, and then get paid after a quick inspection of your. Wrapped is the number one vehicle wrap advertising company in Canada. Wrapped helps drivers across the nation earn passive income for driving routes they would. Track Your Brand. We at BrandOnWheelz are the leading ad agency for car advertising and we are the only company that guarantees you “Highest Brand Visibility”. Welcome to the Application for Public Vehicle Advertising Web Site. Using this web site, you will be able to submit applications, make payments, check the. Do you need to promote your inventory & dealership services? ✓ Cox Auto is a top automotive advertising agency that can get your dealership more visits! SOUTH AFRICA'S LEADING CAR ADVERTISING CO. Make the most of your time on the road on the platform that pays while you drive. We help thousands of drivers earn.

Does Car Insurance Go Up With Speeding Tickets

Speeding tickets at least 30 mph over the speed limit - This speeding ticket can increase your car insurance rates by 30% on average. Not wearing a seatbelt -. Speeding tickets, or any traffic ticket in general, can not only affect your insurance rates but also may affect your ability to drive and even your employment. The short answer is: It depends. Though a speeding ticket could raise your auto insurance rate, your rate may not be affected at all. The last thing you want to be doing when you get pulled over is worry about your insurance, but unfortunately, most insurance companies will take speeding. Car insurance rates can increase by 25% after a speeding ticket. Learn more about why and how you can lower your premium. Yes, speeding tickets affect insurance and the premium you pay. Insurance companies review your driving record and use the information to help them determine. Yes, but not immediately. Motor vehicle reports aren't done at every renewal. And it won't hit your MVR until after the conviction date. Now you're wondering if your car insurance will go up because of it. For most insurers, a speeding ticket will likely raise your rates. Other types of. The number of speeding tickets you have on your record will affect the price increase. The first ticket may not result in a huge increase, but if you have. Speeding tickets at least 30 mph over the speed limit - This speeding ticket can increase your car insurance rates by 30% on average. Not wearing a seatbelt -. Speeding tickets, or any traffic ticket in general, can not only affect your insurance rates but also may affect your ability to drive and even your employment. The short answer is: It depends. Though a speeding ticket could raise your auto insurance rate, your rate may not be affected at all. The last thing you want to be doing when you get pulled over is worry about your insurance, but unfortunately, most insurance companies will take speeding. Car insurance rates can increase by 25% after a speeding ticket. Learn more about why and how you can lower your premium. Yes, speeding tickets affect insurance and the premium you pay. Insurance companies review your driving record and use the information to help them determine. Yes, but not immediately. Motor vehicle reports aren't done at every renewal. And it won't hit your MVR until after the conviction date. Now you're wondering if your car insurance will go up because of it. For most insurers, a speeding ticket will likely raise your rates. Other types of. The number of speeding tickets you have on your record will affect the price increase. The first ticket may not result in a huge increase, but if you have.

How much your auto insurance premiums will increase, if at all, after you receive a speeding ticket depends on several factors. The first is how much you. Speeding tickets typically cause your car insurance premiums to increase, but by how much depends on your state and insurer. In addition to insurance, Nick. If you were significantly exceeding the posted speed limit when you got your first speeding ticket, then your auto insurance rate will likely see an increase. How much will my insurance premium go up after a speeding ticket? On average, you can expect your car insurance policy to increase by roughly 25% at renewal. Yes, a ticket will almost definitely raise your car insurance rate in Texas. But that's only true if you don't do anything about it. The more speeding tickets you have, the more likely you'll see increases in the cost of insurance. Drivers who receive speeding tickets are considered a higher. Once a speeding ticket goes on the driving record, the ticket can affect your insurance for up to three (3) years. Insurance Implications for Speeding. Speeding. The answer is likely yes, speeding tickets may increase the amount you pay for car insurance. Speeding tickets are considered part of your driving record. The violation is going to be recorded on your driving record. And it's going to be reported to your car insurance company. But, how much can you expect your. If you're caught speeding, for example, just how fast you were going over the speed limit will impact the size of your insurance penalty. Getting ticketed for. Getting one speeding ticket will probably not impact your car insurance premium. But there are other factors that might. Do Speeding Tickets Affect Insurance Premiums? In most cases, the answer is yes. If you are issued a ticket for speeding, you can expect your insurance premium. NerdWallet found that car insurance typically increases about 25% after a speeding ticket. Paying the speeding fine and moving on may seem like that best. California traffic tickets can cause auto insurance increases. Take traffic school to keep your car insurance low and driving record clean. Save money! A speeding ticket will increase your car insurance rates by an average of 39%. · Not all car insurance companies rate a speeding ticket the same way, so shopping. And they can impose higher car insurance premiums because of that. Experts say that a single ticket can leave you with a rate hike of anywhere between 7 and 28%. Minor offenses like parking tickets usually don't impact your insurance rates, but moving violations like speeding, DUIs, or reckless driving. Traffic violations: Certain traffic violations, such as speeding, running a red light or stop sign, and reckless driving, may also increase your insurance rates. A speeding ticket affects your auto insurance rates for three to five years, the amount of time most tickets remain on your motor vehicle report. A traffic ticket can have financial consequences beyond the fines you'll pay. Your insurance company may increase your premiums, making it more difficult to.